The cash are www.clickcashadvance.com/installment-loans-ca/london utilized due to a laboratory mortgage that have 15-three decades away from fees. The fresh money can hold a fixed-rate otherwise changeable-price home loan attract.

Authorities backing mode FHA 203k money do have more flexible official certification and you may criteria than antique loans. The mortgage also incorporates the materials and labor towards designed fixes on the household you wanted to buy. Such costs are set in the full you want to obtain.

Complete, 203k fund prices-efficiently pay for many good renovations. However, work secure beneath the FHA 203k loan must start within this 29 times of closure, and also the plans shouldn’t meet or exceed six months doing.

Exactly why are FHA 203k Finance Worthwhile?

When purchasing a house having fun with government-backed fund, you have numerous options. Each regulators-recognized loan is exclusive and you may aim homebuyers with different means.

Low-down money

Having a beneficial 203k mortgage, the duty out of hefty down payments, that are a hurdle to the majority of homebuyers, dramatically minimizes. The required down payment that have an effective 203k loan is 3.5% that’s reasonable priced.

not, that means that you are needed to buy financial insurance. Even with the insurance coverage, this really is nevertheless a cheaper alternative.

So much more versatile requirements

The requirements to help you meet the requirements and just have recognized to have a beneficial 203k financing was flexible. Conditions eg credit score and you may money try straight down which have an effective 203k mortgage it is therefore open to more individuals.

Despite an around excellent credit score, these types of mortgage enables you to get reasonable financing you to definitely you can use to construct your own borrowing by making punctual money for the financing.

Big tax deductions

FHA 203k funds enables you to strike two birds having you to brick, get a property and you may remodel it on the other hand. You’re able to spend more cash on upgrading and you may renovating this new house.

Even better, the loan will enable you while making enormous deals by the claiming taxation write-offs to your home buy focus as well as the household recovery mutual.

Down closing costs

Settlement costs may take right up way too much your home loan. Which have down 203k financing closing costs, you have to pay fewer charges and have extra cash to make the down payment.

Keep your money and you can borrowing

Versus a loan, you would need to turn-to the offers and take aside an extra mortgage to purchase price of the fresh new solutions. Because the FHA 203k suits the expense of buying the household and you may renovating it, you don’t have to decimate your own deals and take a costly financing so you can renovate the house.

It can make most readily useful financial feel

As opposed to a keen FHA 203k loan, you would have to get a normal mortgage to find the house an additional mortgage on the fix costs. Throughout the long haul, which means while making two monthly loan repayments, that offer your finances.

Good 203k mortgage has actually your debt roof reduced as you only have one financing to expend, as well as the payments is down of the straight down rates.

The latest FHA keeps particular standards having residents from Flagler County searching to try to get good 203k loan. Yet not, specific loan providers could have even more requirements desires. However, generally, the prerequisites is:

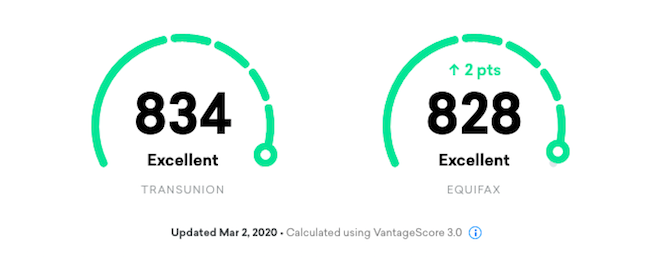

Credit score All the 203k mortgage financial demands your credit rating. Which have FHA 203k, the fresh new being qualified Credit rating was 580, that’s apparently lower. It’s still below the desired 720 or maybe more necessary for antique loans. Certain lenders may require a score away from anywhere between 620-640 to be eligible for the loan.

The newest down-payment Additionally have to have the lowest downpayment to possess FHA fund which is step 3.5%, according to research by the investment prices additionally the property’s price.