Cuyahoga County means a leading-peak housing czar, an union to casing once the a person best – and you will, shortly after more a decade away from discussions, a fund predicated on undertaking and you will preserving reasonable cities to live.

Those individuals are definitely the most readily useful-line suggestions during the a different report, create Monday, October. 10, below thirty days just before voters will like a separate County Government. Brand new 30-web page papers, a variety of browse and you may plan guidance, try developed by nonprofit Organization Society Partners on the behalf of a beneficial broad number of stakeholders concerned about homes, impoverishment and you will monetary balances.

Surratt offers the county and its particular couples higher scratching in a number of elements, for example combating blight due to demolition and you can home improvements towards the land lender

Echoing almost every other look produced while the Higher Market meltdown, this new report illustrates a state with a couple type of homes casing tits, the other disheartened, pulling on the Cornwall Bridge loans better-getting and you can useful communities into Cleveland’s bulk-Black East Top plus close-sleeping suburbs.

The declaration shows that county management is raise you to situation using getting team and investment about four goals: Housing balances. Quicker barriers getting perform-become clients and customers. More powerful fair-houses policies. And you can equitable the fresh new assets.

The Cuyahoga Condition Casing Stakeholder Class is actually holding a discussion out of men and women problems with one another Condition Administrator candidates, Democrat Chris Ronayne and you may Republican Lee Weingart, towards Wednesday, October. twelve. The function, certainly a beneficial flurry away from online forums before the Nov. 8 election, takes place out of 10 an effective.yards. to help you a beneficial.yards. in the Lutheran Metropolitan Ministry into Superior Path in the Cleveland.

Brand new paper lies the fresh groundwork to own a good renew of your county’s very first total property bundle, advised during the 2017 and you may accompanied from the Cuyahoga County Council during the 2019. At the time, state officials and Cuyahoga Land-bank, or Cuyahoga State House Reutilization Corp., collectively the amount of time $31 million so you’re able to casing effort from 2020 using 2025.

But truth be told there nevertheless is strong disparities home based thinking, mortgage availableness and usage of neat and secure property along the condition – variations having ripple consequences toward income tax selections and you will regulators paying towards public features or other means

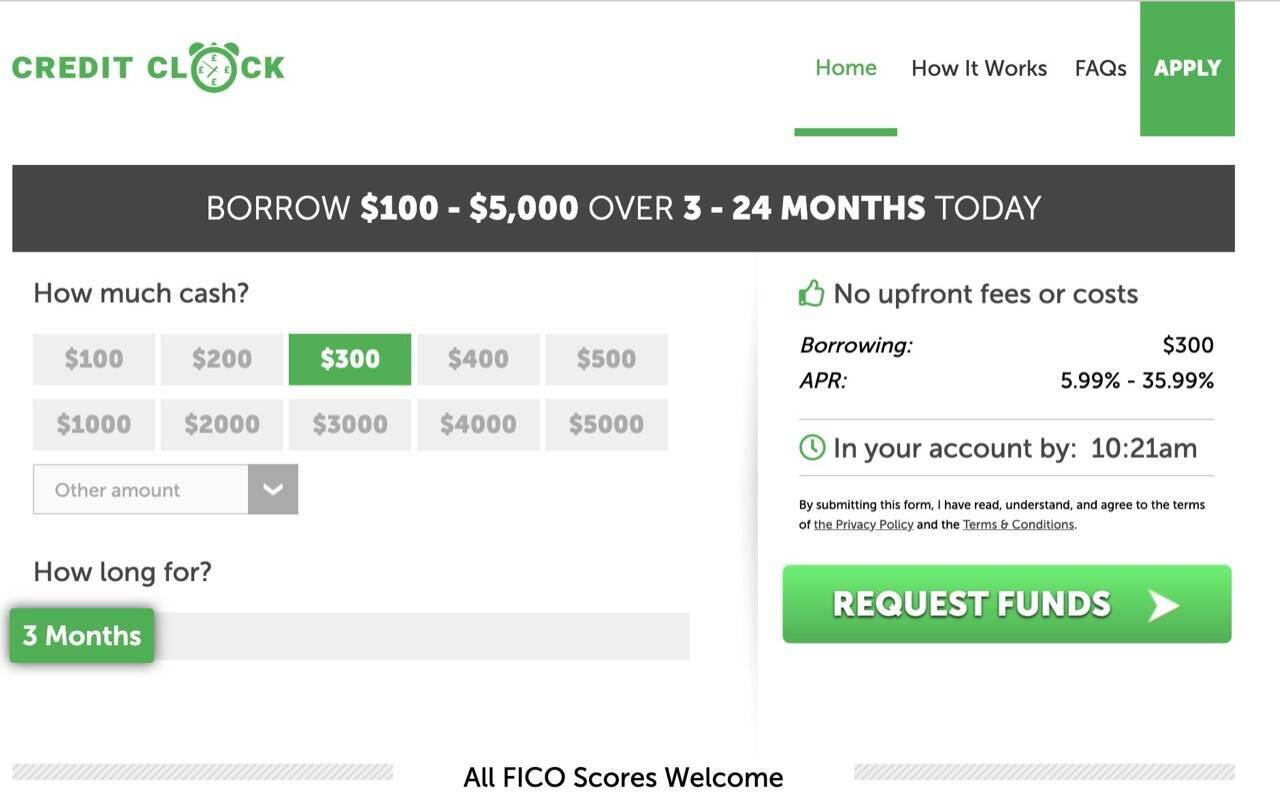

Those funds, away from casino-tax incomes and you can fees to the unpaid possessions-income tax stuff, provides aided get rid of blight, assistance family res to incorporate quick-buck home loans and you can smaller house-resolve financing.

“We’ve seen a good amount of improvements. … But there is however however a good amount of works,” said Emily Lundgard, a great Cleveland-situated elderly system manager for Agency, a nationwide nonprofit worried about boosting accessibility housing.

Lundgard troubled that the statement is not an entire plan. It’s a summary of potential actions, informed from the those teams between the latest Akron Cleveland Relationship off Realtors together with Greater Cleveland Realtist Relationship to the Northeast Ohio Coalition towards Homeless as well as the Cuyahoga Metropolitan Housing Power.

Among trick planks is actually putting money behind a construction believe funds, some thing condition authorities have discussed due to the fact at least 2008. This current year, before the fresh state moved on to a new, executive-contributed sort of regulators, the outdated panel of commissioners recognized producing a housing faith fund designed to help the source of reasonable homes.

Although state never allocated money toward program. Someplace else regarding county, equivalent loans rely on lodge sleep fees, real estate import fees and excessively urban area profits. The fresh new Sensible Property Trust to have Columbus & Franklin County, released when you look at the 2001, also is a beneficial federally official Area Innovation Financial institution and contains accessibility federal features and cash from lenders and you may organizations.

Having the fresh new management for the Cleveland, in which Mayor Justin Bibb took office in the January, and a growing C-package alter from the condition, supporters find a chance to resurrect new dialogue

“There is a genuine potential, whenever we have been taking a look at the reoccurring homes funds, to be looking at one while the a district-county homes funds,” said Lundgard, directing for other habits you to help finance and you will offers to own affordable houses. “This is the gold standard one we viewed.”

In many section, the fresh new declaration suggests a great carrot-and-stick method to designers, landlords as well as urban centers where zoning rules do not let renting otherwise multifamily construction.

Such as, brand new stakeholders advise that the new condition enact resource-of-income safeguards guidelines to eliminate leasing individuals out-of are refuted purely while they trust government housing coupon codes. They also say that voucher software are more straightforward to browse and you can paired with service and you will monetary incentives for residents.

“When you yourself have 90% off landlords which are not accepting vouchers, that makes some thing tough,” told you Ayonna Blue Donald, Enterprise’s vp into Ohio sector.

Just last year, Cuyahoga State Exec Armond Budish revealed an agenda getting legislation to bring countywide origin-of-money defense. However, that laws has not went forward.

Brand new state should also believe a regulation that would club local governing bodies off restricting or forbidding accommodations, new declaration claims, while using state and federal currency once the incentives to help you encourage communities to accept a broader set of residential strategies.

This new paper satisfies toward importance of greatest password administration, more robust domestic-resolve programs, wide down-percentage advice having people and you may possessions-income tax relief for long time property owners in the locations where new development try driving up beliefs. Certain advice echo latest rules proposals from the Very first Suburbs Consortium and you may Cleveland People Advances, who happen to be hosting a region government message board to your October. 20.

The latest county’s operate in the individuals areas can be matched up by an effective cabinet-height certified who can transcend departmental limits, this new homes-concentrated lovers authored.

“This new boundaries bleed. They really carry out. … We have been speaking of drawing personnel, very obtaining the sort of property and locations that satisfy man’s requires is very important,” said Ken Surratt, who offered while the county’s from inside the-domestic construction master off mid-2015 so you’re able to mid-2019.

He could be stayed a person in the fresh new state property stakeholder category, basic while the an enthusiastic outreach manager within Federal Put aside Lender regarding Cleveland and you can, now, once the vice-president off neighborhood funding and you will head investment administrator at the new Joined Way of Greater Cleveland.

Various other stadiums, such as for example which consists of places once the good lever to drive banking institutions to give more freely into hard-strike East Front, the fresh new county could have been less winning.

“For folks who boost the latest roof toward grandma’s household now, in the 10 years whenever possibly she needs to leave one domestic, it might be less expensive for somebody buying. When we assist you to roof go today, then it is an added blighted possessions, very dangerous, not worthy of things, without really worth passed away to the nearest and dearest,” Surratt told you.

“In my opinion,” the guy added, “that would be such as an attractive procedure, observe investment when it comes to those Black and brownish organizations that have been over the years redlined, observe people investment so as that generational money is going to be enacted off inside the housing.”